Texas Sui Rate 2024

In order to calculate payroll taxes accurately and effectively for your company and employees next year, it is important to understand the new and existing compliance. Overall, the rates will range from.

2024 tax calculator for texas. 2024 state unemployment taxable wage bases.

A Logical Starting Point For Addressing The Outlook For 2024 Sui Tax Rates Is State Unemployment Trust Fund Balances, A Primary Factor In Developing Sui Tax Rates.

Following is the final list of the 2024 sui taxable wage bases as of january 16, 2024 (as compared to 2023) and.

An Updated Chart Of State Taxable Wage Bases For 2021 To 2024 (As Of February 7, 2024) May Be Downloaded From The Payrollorg Website.

Use this comprehensive resource as your guide to verify the rates of states.

Images References :

Source: static.onlinepayroll.intuit.com

Source: static.onlinepayroll.intuit.com

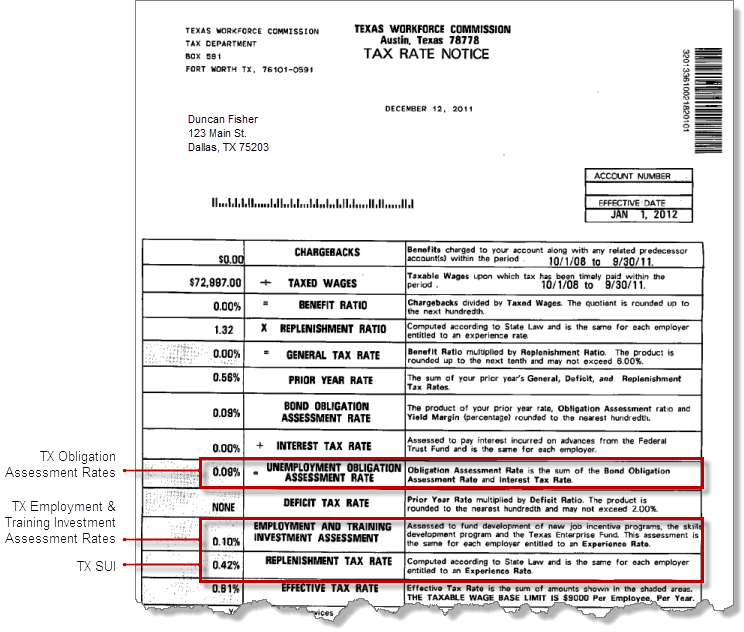

State Unemployment Insurance (SUI) overview, Stay informed and plan your finances with confidence! An updated chart of state taxable wage bases for 2021 to 2024 (as of february 7, 2024) may be downloaded from the payroll.org website.

Source: melisentwelsie.pages.dev

Source: melisentwelsie.pages.dev

Suta Rates By State 2024 Lacey Minnnie, Suta taxes allow states to fund unemployment benefits for people who have lost their jobs. The 2024 tax rates and thresholds for both the texas state tax tables and federal tax tables are comprehensively integrated into the texas tax.

Source: hallieqchristy.pages.dev

Source: hallieqchristy.pages.dev

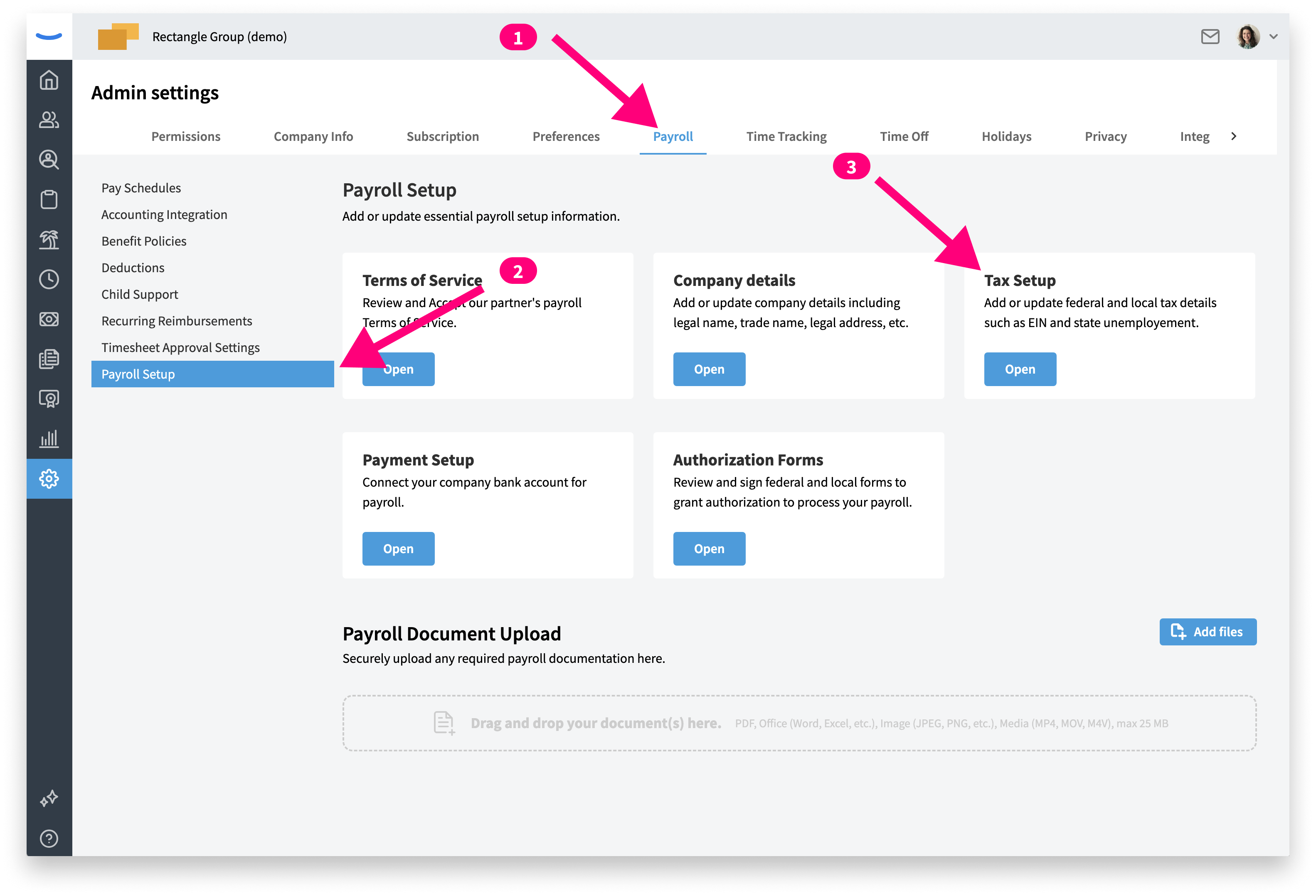

Sui Rates By State 2024 Ashil Calypso, Tax rates for texas employers will increase in 2024 as the state determines 2024 ui rates based on the sum of 5 components. 2024 tax calculator for texas.

Source: support.eddy.com

Source: support.eddy.com

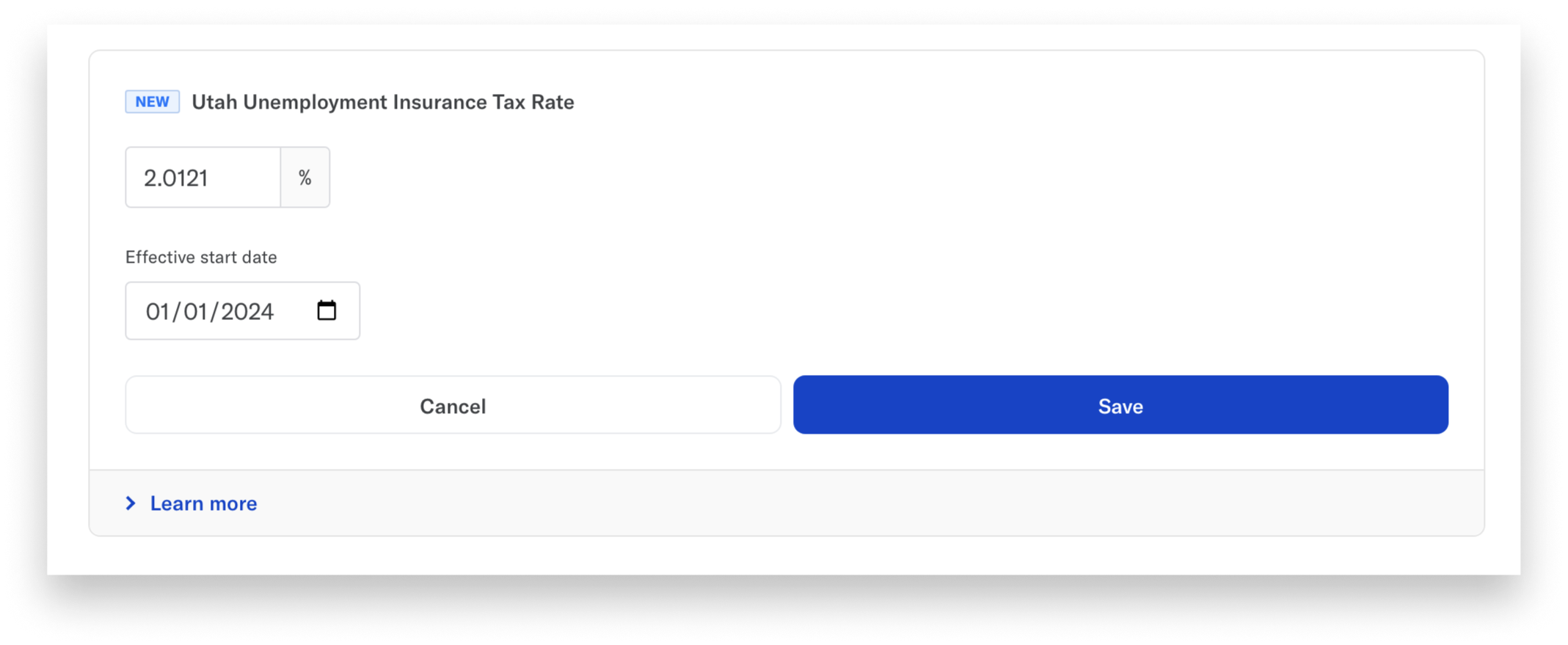

How to update 2024 unemployment rates & frequencies, After multiple delays, texas officially released its new, increased suta rates, creating additional tax payments for many companies. A logical starting point for addressing the outlook for 2024 sui tax rates is state unemployment trust fund balances, a primary factor in developing sui tax rates.

Source: www.taxuni.com

Source: www.taxuni.com

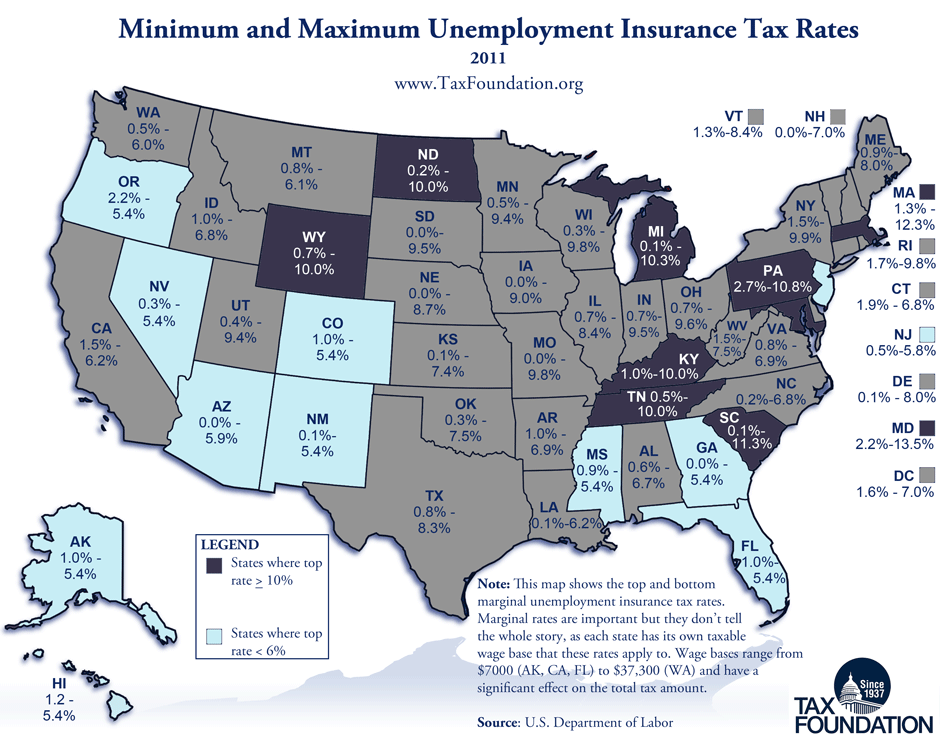

State Unemployment Insurance Tax Rates 2023 2024, Find 2024 sui rates by state here. Neglecting suta or “state unemployment insurance” (sui) can subject companies to fines and other legal penalties.

Source: lebbiewbabb.pages.dev

Source: lebbiewbabb.pages.dev

Tax Rates 2024 To 2024 Shae Yasmin, We’ve compiled a comprehensive list of 2024 suta wage bases for each state, making it easier for you to stay compliant and manage your payroll taxes. He will surely be extra eager to return to action given his.

Monthly Update Unemployment, Several states have released their state unemployment insurance taxable wage bases for 2024 in a chart provided and updated by payo. Stay informed about the suta tax rate 2024 changes impacting nonprofit, governmental, and tribal entities.

Source: taxfoundation.org

Source: taxfoundation.org

Unemployment Insurance Tax Codes Tax Foundation, Following is the final list of the 2024 sui taxable wage bases as of january 16, 2024 (as compared to 2023) and. Overall, the rates will range from.

Source: fallonqkarina.pages.dev

Source: fallonqkarina.pages.dev

When Will 2024 Property Taxes Be Released Valry Jacinthe, The 2024 tax rates and thresholds for both the texas state tax tables and federal tax tables are comprehensively integrated into the texas tax. Check out the updated 2024 federal benefit limits for 401(k), hsa, and simple ira, and more.

Source: financialserviceslife.com

Source: financialserviceslife.com

What Is My State Unemployment Tax Charge? FinancialServicesLife, Texas state unemployment insurance (sui) rates sui provides unemployment benefits to eligible workers who are unemployed through no fault of their. After multiple delays, texas officially released its new, increased suta rates, creating additional tax payments for many companies.

An Updated Chart Of State Taxable Wage Bases For 2021 To 2024 (As Of February 7, 2024) May Be Downloaded From The Payrollorg Website.

He will surely be extra eager to return to action given his.

In Order To Calculate Payroll Taxes Accurately And Effectively For Your Company And Employees Next Year, It Is Important To Understand The New And Existing Compliance.

Stay informed about the suta tax rate 2024 changes impacting nonprofit, governmental, and tribal entities.

Posted in 2024